How does cashback work?

March 25, 2025

|

12 min read

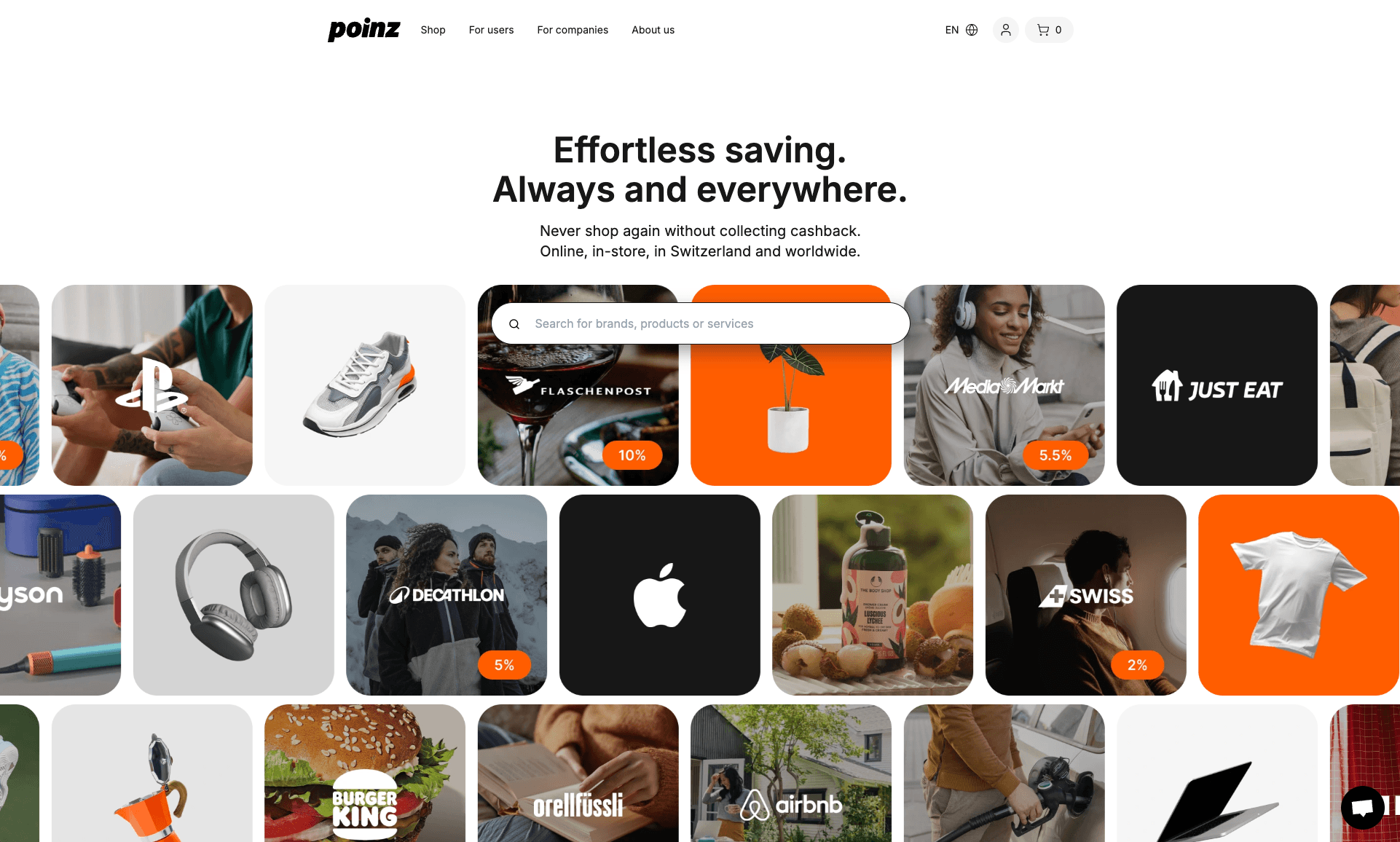

Cashback is a reward system where you receive a portion of the money you spent on purchases back. It is offered by credit card companies, banks, or specialized cashback platforms and is a popular method for customer retention.

In this article, we explain exactly how a cashback program works, how much money you can save, and what you should pay attention to.

How does the cashback principle work?

When you purchase a product or service, you receive a percentage of the purchase amount back—usually as a credit or reward points. This refund can either be credited to your account or your credit card.

How much can you save?

With a holistic cashback platform, you can save up to CHF 1,000 per year in Switzerland. On the poinz platform, you receive a portion of the amount spent on all your purchases—whether online or in physical stores. poinz also offers a cashback credit card, which allows you to earn up to 1% cashback worldwide.

Pay attention to time-limited cashback increases from certain providers. This way, you can collect significant cashback with just a few purchases—for example, with airlines like SWISS or when buying electronics (Apple, MediaMarkt, Fust, etc.).

How and where do I receive my cashback?

Depending on the cashback program, there are different ways to get your money back. The exact process depends on whether you use cashback via a credit card, a cashback platform, or directly from a retailer.

Cashback via online platforms

For platforms like poinz, Rabattcorner, or Monerio, the process works as follows:

Create an account: Sign up for free on the cashback platform.

Make a purchase: To earn cashback, visit the desired online store via the special (affiliate) link provided by the platform.

Receive cashback: After completing your purchase, your cashback is initially recorded in your platform account until the product’s return period expires.

Payout: Once your cashback is approved, you can withdraw it—depending on the platform—via

bank transfer, PayPal, or as a voucher for another store.

Cashback via credit cards

If you use a cashback credit card, the refund process happens automatically:

Make a purchase: Pay with your cashback credit card.

Collect cashback: A percentage of the amount spent is automatically credited to your credit card account.

Payout: The cashback amount is either deducted from your

monthly credit card statement or transferred to your bank account. Some providers also allow you to use collected cashback as credit for future purchases.

;

;Easily collect cashback with your credit card.

Cashback from retailers

Some retailers offer their own/direct cashback promotions:

Complete your purchase: Buy a product that is part of a cashback promotion.

Provide proof: You often need to submit a receipt or proof of purchase to receive the cashback—either via an online form or by sending in your receipt.

Receive cashback: After confirmation, the cashback is usually credited to your account as a

bank transfer or voucher for future purchases.

Common payout methods

Bank transfer: Many programs offer direct cashback payouts to your bank account.

PayPal: Most online cashback platforms provide payouts via PayPal.

Credits: Cashback credit cards or retailers often offer credits to your card account or vouchers for future purchases.

By following these steps, you can easily collect and redeem your cashback for future expenses. 🚀

Who pays my cashback?

The cashback is paid by the companies involved, who benefit from the transaction. It works in different ways, depending on the cashback system.

Merchants (retailers and online stores)

Merchants offer cashback as part of their marketing and customer retention strategies. They pay the cashback either directly or via a commission to the cashback platform or bank. The idea behind this is that they expect to generate more sales by encouraging customers to shop with them. Therefore, the cashback is treated as a form of discount or advertising expense.

Cashback Platforms

Platforms like poinz work by receiving a commission from partner merchants when they refer customers. A portion of this commission is then given back to the customer as cashback. The platform keeps the other part as profit.

Pros and cons of cashback

Pros

Save money: If you shop actively through a cashback platform, you can save a lot of money

Simple and easy: Unlike traditional discounts or loyalty programs, cashback is easy to use. There’s no complex points system or coupons to redeem. You spend money, and a certain percentage is directly refunded to you.

Variety and relevance: Cashback systems cover a wide range of expenses, including purchases at retailers, online shopping, gas, or even utility bills. Many cashback credit cards offer specific incentives for certain categories (e.g., more cashback for groceries, travel, or restaurants).

Combine with other offers: The cashback you collect can often be used in different ways. You can cash it out directly, credit it to your credit card, or use it for future purchases. Some providers also allow you to convert cashback into vouchers or reward points.

Long-term financial benefits: For regular users of cashback programs, the long-term benefits can be significant, especially with larger purchases or recurring expenses. This makes it an effective way to save money in the long run without extra effort.

Cons

Temptation to spend more: Consumers might be tempted to make unnecessary purchases just to get cashback.

Terms and restrictions: Sometimes, certain products or services are excluded, or cashback can only be redeemed once a certain threshold is reached.

Expiration of cashback: Some programs have deadlines after which accumulated cashback expires if not redeemed.

Where can I collect cashback?

There are many ways you can collect cashback. Through cashback platforms, you can get money back with a program at many participating companies. However, there are also many companies that offer cashback directly. Additionally, so-called cashback credit cards are becoming increasingly popular, allowing you to receive cashback on every transaction, regardless of the company. Here's a brief overview:

Websites and apps

So-called cashback platforms are becoming increasingly popular in Switzerland, as you can collect cashback directly with hundreds of companies using just one account. However, there are some differences between the platforms themselves. When choosing a platform, make sure that you can collect cashback on as many of your daily expenses as possible: online, in physical stores, in Switzerland, and worldwide.

Credit cards

In Switzerland, there are now several credit card providers offering attractive cashback on every transaction. These credit cards are usually completely free, allowing you to save a lot of money each year. For example, the independent comparison service Moneyland.ch has ranked the cashback credit cards from poinz as some of the best credit cards in Switzerland in recent years (you can view the official credit card comparison here: https://www.moneyland.ch/de/creditcard/index).

Cashback from big companies

In Switzerland, you’re seeing more and more cashback campaigns from big brands, which give customers a portion of the purchase amount back directly. These promotions are becoming more common, for example, with mobile phone providers or electronics retailers.

What cashback platforms are there in Switzerland?

In Switzerland, there are several cashback platforms:

www.poinz.ch

www.rabattcorner.ch

www.monerio.ch

;

;The innovative online cashback platform from poinz launches in September 2024.

Conclusion

Cashback is a simple and effective tool for saving money on everyday purchases and larger investments. It offers many benefits, including direct reimbursements, ease of use, and flexibility, making it possible to save on both small and regular expenses. Cashback programs are particularly attractive because they have no complex conditions and can often be used in combination with other discounts.

For consumers, cashback means not only immediate financial savings but also the chance to gain long-term benefits by cleverly using credit cards and cashback platforms. The ability to collect cashback in various areas such as shopping, travel, fueling, and online shopping makes it highly versatile.

However, cashback should be used with caution to avoid the trap of making unnecessary purchases just to get cashback. The real savings potential unfolds when you shop intentionally and consciously, choose the best cashback options, and strategically use the collected reimbursements.

Overall, cashback is a great way to make everyday life a bit cheaper—with minimal effort and maximum benefit.

FAQs

Is collecting cashback worth it?

Yes, collecting Cashback can be worthwhile if used consciously and strategically. Here are some reasons why collecting Cashback can be beneficial:

Direct savings on everyday expenses

Versatile usage possibilities

Easy to use

Combination with other discounts

Long-term saving potential

Limitations and caution

Although Cashback offers many benefits, there are also some potential drawbacks to watch out for:

Temptation to spend more: Some consumers might be tempted to make unnecessary purchases just to get Cashback. In this case, spending may outweigh the actual savings.

Conditions and limits: Some programs have conditions or minimum amounts before Cashback can be paid out. It’s important to keep these restrictions in mind to avoid disappointment.

How do I get my money back?

Cashback is usually credited automatically to your account or credit card.

How long does it take for the money to appear in my account?

This can vary greatly as several factors need to be considered. For example, many companies offer customers a return period. Therefore, a final Cashback credit can only happen after this period. In most cases, the Cashback is provisionally credited immediately, and after the cancellation/return period has passed, the final credit is issued.